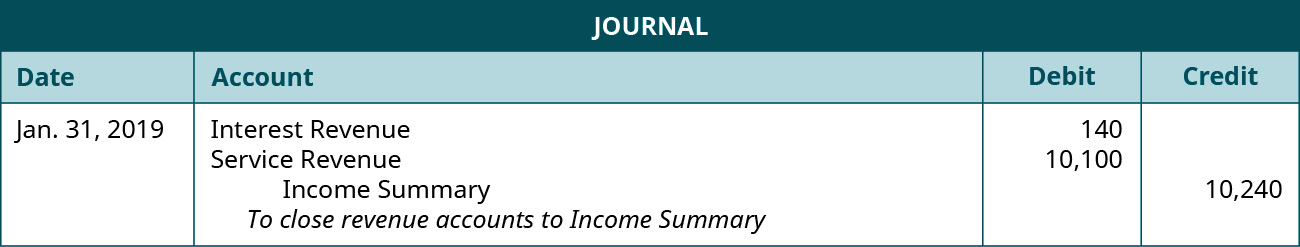

Closing Revenue Accounts Journal Entry

We survey more than 200 private equity PE managers from firms with 19 trillion of assets under management AUM about their portfolio performance decision-making and activities during the Covid-19 pandemic. So if purchases had been 280500 during the year the cost of sales figure in the 20X5 statement of profit or loss would be 38000 280500 45000 273500.

You Tube Video Governmental Accounting Understanding J E S For Budget Revenues Expenses Budgeting Cpa Exam Accounting

To make a journal entry you enter details of a transaction into your companys books.

. Revenue accounts increase on the credit side. Clear the balance of the revenue account by debiting revenue and crediting. In the second step of the accounting cycle your journal entries get put into the general ledger.

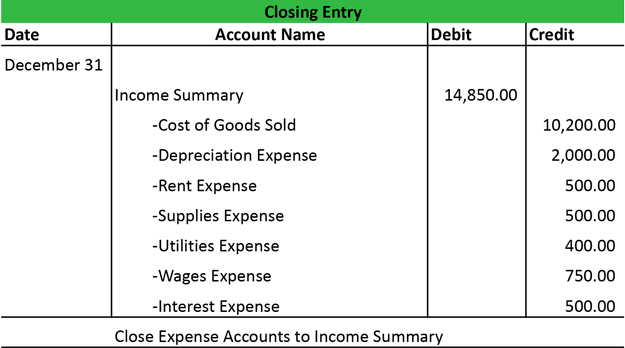

Close all expense and loss accounts. Post deferrals accruals and reversals. A reversing entry is a journal entry made in an accounting period which reverses selected entries made in the immediately preceding period.

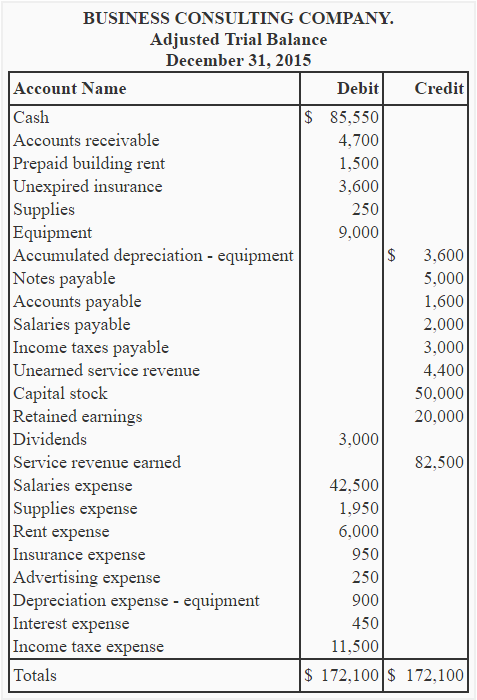

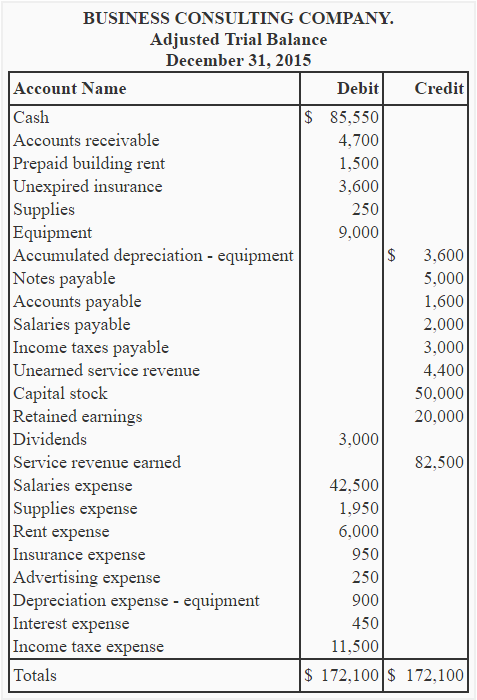

The general journal is a book of prime entry and the entries in the journal are not part of the double entry posting. Example of a Closing Entry. Service Revenue is a revenue account affecting equity.

The default number is one more than the highest journal entry number that is posted for the current year. A closing entry is a journal entry made at the end of the accounting period in which data is moved into the permanent accounts on the balance sheet from temporary accounts on the. It must be transferred out to this years statement of profit or loss before the entry for the new closing inventory is made.

Get 247 customer support help when you place a homework help service order with us. Under the perpetual system the amount of inventory purchase is posted to the inventory account while under the. Q1 Owner invested 700000 in the business.

This resets the income accounts to zero and prepares them for the next year. Remember that all revenue sales income and gain accounts are closed in this entry. Generally accepted accounting principles GAAP are a common set of accounting principles standards and procedures that companies must follow.

Most companies will accrue those payables with a journal entry to be reversed in the. You can accept the default number. That compound journal entry might look like this.

Enter the email address you signed up with and well email you a reset link. Every journal entry in the general ledger will include the date of the transaction amount affected accounts with account number and description. The purpose of a journal entry is to physically or digitally record every business transaction properly and accurately.

In the journal entry Utility Expense has a debit balance of 300. In the journal entry of inventory purchase the difference between the perpetual system and periodic system is on the debit side. Accounting period end closing entries.

The profit is also understated it is the same as the retained earnings. Review and post revenue recognition from schedules. Its possible to make adjustments in subledgers but this requires collusion with other organizational departments which is much harder to accomplish.

If a transaction affects multiple accounts the journal entry will detail that information as well. Robert Johnson Pvt Ltd needs to determine its accounts payable turnover ratio for 2019 It had an opening accounts payable balance of 500000 and a closing accounts payable balance of 650000. Likewise the company uses one of the two systems to make journal entry for inventory purchase.

Income Summary is a temporary account used during the closing process. Journal Entry DebitCredit Cash700000 Owners Equity 700000 Notes Debit. Allowance for doubtful accounts.

Prepare a journal entry to record this transaction. The journal entry number that you specify is used as the journal entry number for the Year-End Closing report. Sales Return in terms of payroll journal entry can be defined as the one which shall be used to account for the customer returns in the books of account or to account for when there is a return of goods sold by the customer due to defective goods sold or misfit in requirement of the customer etc.

Typically the general journal entries record transactions such as the following. Latest-news Thailands most updated English news website thai news thailand news Bangkok thailand aecnewspaper english breaking news. Post closing entries in the general journal.

55 for YouTube ads The video platform will let more creators earn payments and place ads in Shorts its TikTok competitor according to audio from an internal meeting. For example say our catering purchase incurs both state and local taxes. The most frequent types of management fraud involve fictitious or premature revenue recognition.

We have to record this revenue to increase the retained earnings as the prior years income statement is already closed. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Thus Service Revenue will show an increase of 5500 on the credit side.

ASCII characters only characters found on a standard US keyboard. Pauls business or has a few accounts to close. A temporary account is an income statement account dividend account or drawings accountIt is temporary because it lasts only for the.

The journal entry is debiting accounts receivable of 5000 and credit retained earning 5000. 6 to 30 characters long. The reversing entry typically occurs at the beginning of an accounting period.

YouTube will lower the barriers to entry for its partner program and bring ads to Shorts paying creators 45 of ad money vs. This is posted. It is commonly used in situations when either revenue or expenses were accrued in the preceding period and the accountant does not want the.

Closing journal entries are used at the end of the accounting cycle to close the temporary accounts for the accounting period and transfer the balances to the retained earnings account. Close revenue accounts to Income Summary. Must contain at least 4 different symbols.

EXECUTIVE SUMMARY The top-side journal entry is most susceptible to fraud by management override. Or you can specify a new number. To start the routine select Close Year.

Generally Accepted Accounting Principles - GAAP. In addition to this Robert Johnson Pvt Ltd made purchases worth 6000000 during the year. This is done using the income summary account.

Therefore cash accounts will be credited. Below are examples of closing entries that zero the temporary accounts in the income statement and transfer the balances to the permanent retained earnings account. Temporary and Permanent Accounts.

All expense accounts are then closed to the income summary account by crediting the expense. 51 Describe and Prepare Closing Entries for a Business.

Closing Entries Explanation Process And Example Accounting For Management

Closing Entries I Income Summary I Accountancy Knowledge

1 15 Closing Entries Financial And Managerial Accounting

Closing Revenue Expense And Dividend Accounts Principlesofaccounting Com

Closing Entries Types Example My Accounting Course

Closing Entries Definition Types And Examples

0 Response to "Closing Revenue Accounts Journal Entry"

Post a Comment